快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出61题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

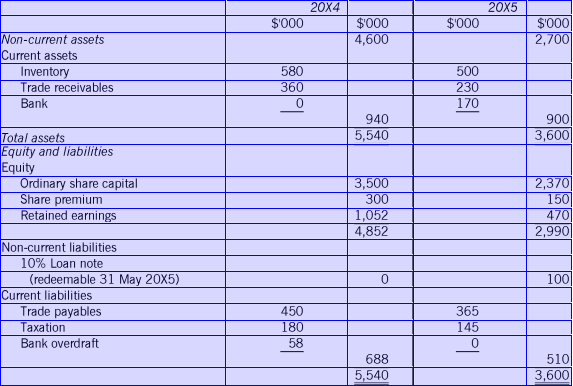

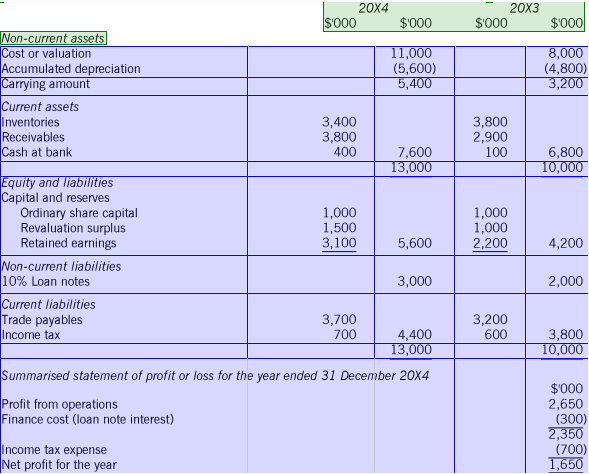

The following information is available for Sioux, a limited liability company:Statements of financial position

1 During the year non-current assets which had cost $800,000, with a carrying amount of $350,000, were sold for $500,000.

2 The revaluation surplus arose from the revaluation of some land that was not being depreciated.

3 The 20X3 income tax liability was settled at the amount provided for at 31 December 20X3.

4 The additional loan notes were issued on 1 January 20X4. Interest was paid on 30 June 20X4 and 31 December 20X4.

5 Dividends paid during the year amounted to $750,000.

Prepare the company's statement of cash flows for the year ended 31 December 20X4, using the indirect method, adopting

the format in IAS 7 Statement of cash flows.

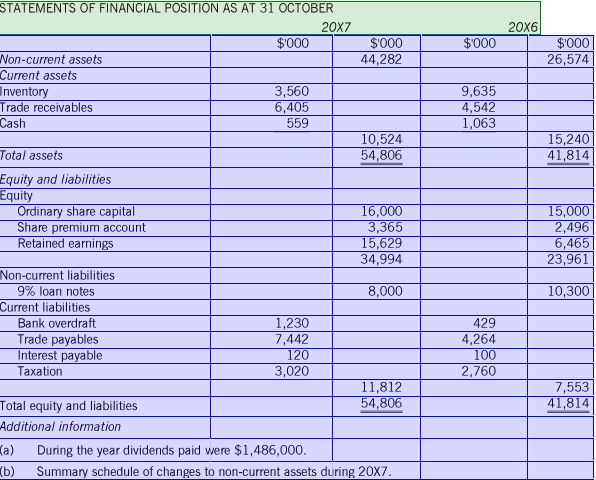

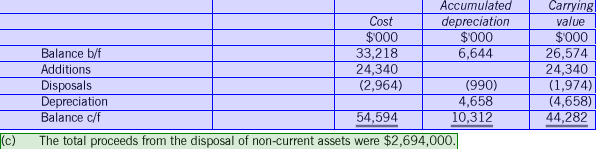

Geofost is preparing its statement of cash flows for the year ended 31 October 20X7. You have been presented with the

following information.

GEOFOST

STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 OCTOBER 20X7

Profit from operations 15,730

Finance cost (730)

Profit before tax 15,000

Taxation (4,350)

Profit for the year 10,650

Required

Prepare a statement of cash flows for Geofost for the year ended 31 October 20X7 in accordance with IAS 7 Statement of

cash flows, using the indirect method.

The statement of financial position as at 31 October 20X6

材料全屏

53

【简答题】

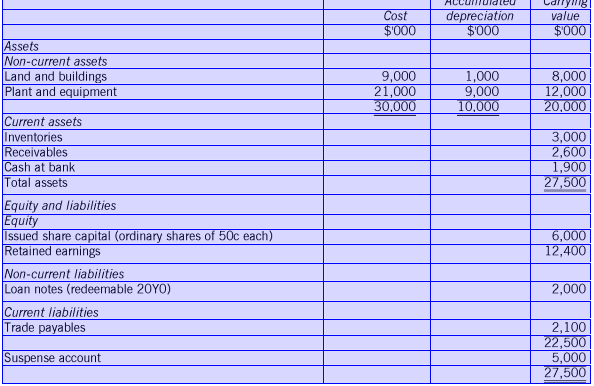

The proceeds of issue of 4,000,000 50c shares at $1.10 per share, credited to the suspense account from the cash book.

The balance of the account is the proceeds of sale of some plant on 1 January 20X4 with a carrying amount at the date of sale of $700,000 and which had originally cost $1,400,000. No other accounting entries have yet been made for the disposal apart

from the cash book entry for the receipt of the proceeds. Depreciation on plant has been charged at 25% (straight line basis)

in preparing the draft statement of financial position without allowing for the sale. The depreciation for the year relating to the

plant sold should be adjusted for in full.

材料全屏

55

【简答题】

Closing inventory has been counted and is valued at $75,000.

The items listed below should be apportioned as indicated.

Cost of Distribution Administrativesales costs expenses

% % %

Discounts received - - 100

Energy expenses 40 20 40

Wages 40 25 35

Directors' remuneration - - 100

An invoice of $15,000 for energy expenses for October 20X7 has not been received.

材料全屏

58

【简答题】

The statement of profit or loss for the year ended 31 May 20X5 shows the following.

$'000

Operating profit 1,042

Interest payable (10)

Profit before taxation 1,032

Taxation (180)

Profit for financial year 852

During the year dividends paid were $270,000.