快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

What are the constraints in the situation facing WX Co?

【论述题】

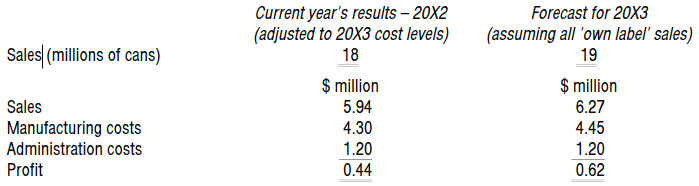

Prepare a contribution breakeven chart for 20X3 assuming that all sales will be 'own label'.

Prepare a contribution breakeven chart for 20X3 assuming that 50% of sales are 'own label' and 50% are of the BD brand.

Comment on the positions shown by the charts and your calculations and discuss what other factors management should consider before making a decision.

Q plc makes two products – Quone and Qutwo – from the same raw material. The selling price and cost details of these products are as shown below:

Quone Qutwo

$ $

Selling price 20.00 18.00

––––– –––––

Direct material ($2.00 per kg) 6.00 5.00

Direct labour 4.00 3.00 Variable overhead 2.00 1.50

––––– –––––

12.00 9.50

––––– –––––

Contribution per unit 8.00 8.50

The maximum demand for these products is 500 units per week for Quone, and an unlimited number of units per week for Qutwo.

What would the shadow price of these materials be if material were limited to 2,000 kgs per week?

P is considering whether to continue making a component or to buy it from an outside supplier. It uses 12,000 of the components each year.

The internal manufacturing cost comprises:

$/unit

Direct materials 3.00

Direct labour 4.00

Variable overhead 1.00

Specific fixed cost 2.50

Other fixed costs 2.00

–––––

12.50

–––––

If the direct labour were not used to manufacture the component, it would be used to increase the production of another item for which there is unlimited demand. This other item has a contribution of $10.00 per unit but requires $8.00 of labour per unit.

What is the maximum price per component, at which buying is preferable to internal manufacture?

The following details relate to three services provided by RST Company:

All three services use the same type of direct labour which is paid $25 per hour.

The fixed overheads are general fixed overheads that have been absorbed on the basis of machine hours.

What are the most and least profitable uses of direct labour, a scarce resource?

A linear programming model has been formulated for two products, X and Y. The objective function is depicted by the formula C = 5X + 6Y, where C = contribution, X = the number of product X to be produced and Y = the number of product Y to be produced.

Each unit of X uses 2 kg of material Z and each unit of Y uses 3 kg of material Z. The standard cost of material Z is $2 per kg. The shadow price for material Z has been worked out and found to be $2.80 per kg.

If an extra 20 kg of material Z becomes available at $2 per kg, what will the maximum increase in contribution be?

The shadow price of skilled labour for CBV is currently $8 per hour.

What does this mean?

Mark the following on the P/V chart below.

• Breakeven point • Contribution

• Fixed costs • Profit