快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

A company makes products A and B. It is experimenting with Activity Based Costing. Production set-up costs are $12,000; total production will be 20,000 units of each of products A and B. Each run is 1,000 units of A or 5,000 units of B.

What is the set-up cost per unit of A, using ABC?

Fill in the blanks. The major ideas behind ABC are as follows.

(a) Activities cause _____________

(b) Producing products creates demand for the _____________

(c) Costs are assigned to a product on the basis of the product's consumption of the _____________

【论述题】

Calculate the production overheads to be absorbed by one unit of each of the products using the following costing methods.

A traditional costing approach, using a direct labour hour rate to absorb overheads

Calculate the production overheads to be absorbed by one unit of each of the products using the following costing methods.

An activity based costing approach, using suitable cost drivers to trace overheads to products

【论述题】

Calculate the overhead cost per course for auditing using traditional volume based absorption costing to the nearest dollar.

Which THREE of the following statements about activity-based costing are correct?

(1) Implementation of ABC is unlikely to be cost-effective when variable production costs are a low proportion of total production costs.

(2) In a system of ABC, for costs that vary with production levels, the most suitable cost driver is likely to be direct labour hours or machine hours.

(3) Activity based costs are not the same as relevant costs for the purpose of short-run decision making.

(4) Activity based costing is a form of absorption costing.

Which of the following statements about activity based costing are true?

The following statements have been made about traditional absorption costing and activity based costing.

(1) Traditional absorption costing may be used to set prices for products, but activity based costing may not.

(2) Traditional absorption costing tends to allocate too many overhead costs to low-volume products and not enough overheads to high-volume products.

(3) Implementing ABC is expensive and time consuming

Which of the above statements is/are true?

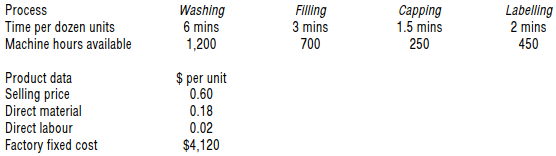

The following data refers to a soft drinks manufacturing company that passes its product through four processes and is currently operating at optimal capacity.

Which process is the bottleneck?

In which of the following ways might financial returns be improved over the life cycle of a product?

1. Maximising the time to market

2. Minimising the breakeven time

3. Maximising the length of the life cycle