快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

The following statements have been made about budgeting.

(1) An incremental budget is a budget which is designed to change as the volume of output changes.

(2) Zero-based budgeting is used to compare the incremental cost and related benefits of activities.

Which of the above statements is/are true?

Which of the following is a characteristic of feedback?

A budget that is continuously updated by adding a further accounting period (a month or a quarter) when the earlier accounting period has expired is known as a:

The following statements have been made about zero base budgeting.

(1) The zero base budgeting process seeks to identify long-term benefits and improvements, even if they are sometimes made at the expense of short-term profitability.

(2) A barrier to the use of zero base budgeting is the possibility that management may not have the skills to apply it.

Which of the above statements is/are true?

A control system that reacts to historical changes in the business environment, usually to maintain a desired state of operations, is known as:

The following statements have been made about feed-forward control budgetary systems:

(1) Feedforward control systems have an advantage over other types of control in that it establishes how effective planning was.

(2) Feedforward control occurs while an activity is in progress.

Which of the above statement(s) is/are true?

An incremental budgeting system is:

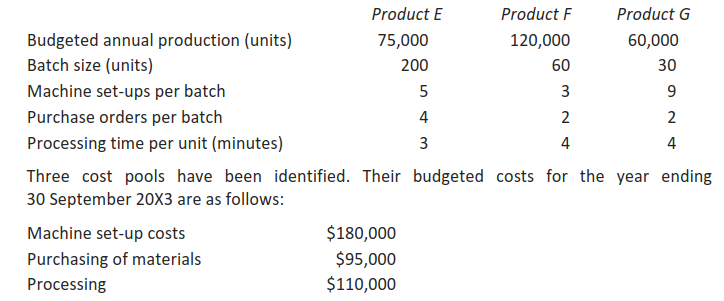

EFG uses an Activity Based Budgeting system. It manufactures three products, budgeted details of which are set out below:

What is the budgeted machine set-up cost per unit of product F?

What is the budgeted machine set-up cost per unit of product F?

The following statements have been made regarding different types of budget:

(i) A flexible budget can be used to control operational efficiency.

(ii) Incremental budgeting can be defined as a system of budgetary planning and control that measures the additional costs that are incurred when there are unplanned extra units of activity.

(iii) Rolling budgets review and, if necessary, revise the budget for the next quarter to ensure that budgets remain relevant for the remainder of the accounting period.

Which of the above statement(s) are true?

X Co uses rolling budgeting, updating its budgets on a quarterly basis. After carrying out the last quarter’s update to the cash budget, it projected a forecast cash deficit of $400,000 at the end of the year. Consequently, the planned purchase of new capital equipment has been postponed.

Which of the following types of control is the sales manager’s actions an example of?