快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Which one of the following statements does NOT explain why coding systems are used?

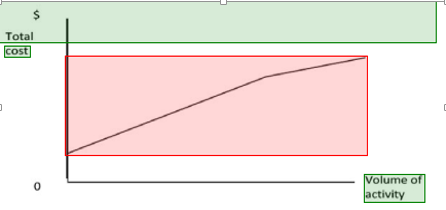

The following diagram represents the behaviour of one element of cost:Which one of the following descriptions is consistent with the above diagram?

An organisation has the following total costs at three activity levels:

Activity level (units) 8,000 12,000 15,000

Total cost $204,000 $250,000 $274,000

Variable cost per unit is constant within this activity range and there is a step up of 10% in the total fixed costs when the activity level exceeds 11,000 units.What is the total cost at an activity level of 10,000 units?

A firm has to pay a $0.50 per unit royalty to the inventor of a device which it manufactures and sells. How would the royalty charge be classified in the firm's accounts?

Which of the following can be included when valuing inventory?

(i) Direct material

(ii) Direct labour

(iii) Administration costs

(iv) Production overheads

Which of the following is usually classed as a step cost?

Which of the following is not a cost objects?

Which of the following describes depreciation of fixtures?

Which of the following costs would NOT be classified as a production overhead cost in a food processing company?

There is to be an increase next year in the rent from $12,000 to $14,000 for a warehouse used to store finished goods ready for sale. What will be the impact of this increase on the value of inventory manufactured and held in the warehouse?