快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出329题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

An invoice of $15,000 for energy expenses for October 20X7 has not been received.

材料全屏

58

【简答题】

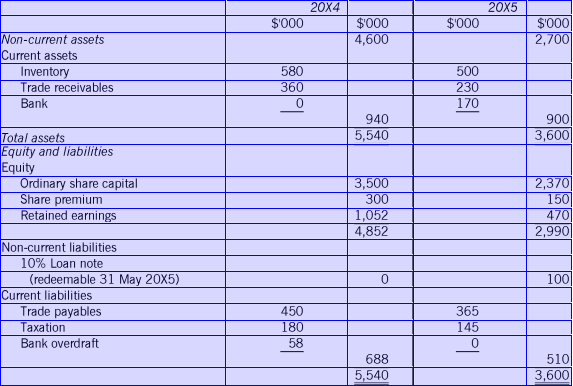

The statement of profit or loss for the year ended 31 May 20X5 shows the following.

$'000

Operating profit 1,042

Interest payable (10)

Profit before taxation 1,032

Taxation (180)

Profit for financial year 852

During the year dividends paid were $270,000.

After checking a business cash book against the bank statement, which of the following items could require an entry in

thecash book?

1 Bank charges

2 A cheque from a customer which was dishonoured

3 Cheque not presented

4 Deposits not credited

5 Credit transfer entered in bank statement

6 Standing order entered in bank statement.

The following bank reconciliation statement has been prepared for a company:

$

Overdraft per bank statement 39,800

Add: Deposits credited after date 64,100

103,900

Less: Unpresented cheques presented after date 44,200

Overdraft per cash book 59,700

Assuming the amount of the overdraft per the bank statement of $39,800 is correct, what should be the balance in the cash

book?

Listed below are five potential causes of difference between a company's cash book balance and its bank statement balance

as at 30 November 20X3:

1 Cheques recorded and sent to suppliers before 30 November 20X3 but not yet presented for payment

2 An error by the bank in crediting to another customer's account a lodgement made by the company

3 Bank charges

4 Cheques paid in before 30 November 20X3 but not credited by the bank until 3 December 20X3

5 A cheque recorded and paid in before 30 November 20X3 but dishonoured by the bank

Which one of the following alternatives correctly analyses these items into those requiring an entry in the cash book and those that would feature in the bank reconciliation?

Cash book entry Bank reconciliation

The bookkeeper of Peri made the following mistakes:Discount allowed $3,840 was credited to discounts received account.

Discount received $2,960 was debited to discountsallowed account. Discounts were otherwise correctly recorded.Which one

of the following journal entries will correct the errors?

Dr Cr

$ $

The following are balances on the accounts of Luigi, a sole trader, as at the end of the current financial year and after all

entries have been processed and the profit for the year has been calculated

The following balances have been extracted from the nominal ledger accounts of Tanya, for bank loan is unknown. There are no other accounts in the main ledger

.Payables $ 27,000

Capital 66,000

Purchases 160,000

Sales 300,000O

ther expenses 110,000

Receivables 33,000

Purchase returns 2,000

Non-current assets 120,000

Cash in bank 18,000

Bank loan UnknownWhat is the credit balance on the bank loan account?

The electricity account for Jingles Co for the year ended 30 June 20X1 was as follows.

$

Opening balance for electricity accrued at 1 July 20X0 300

Payments made during the year

1 August 20X0 for three months to 31 July 20X0 600

1 November 20X0 for three months to 31 October 20X0 720

1 February 20X1 for three months to 31 January 20X1 900

30 June 20X1 for three months to 30 April 20X1 840

Jingles Co expects the next bill due in September to be for the same amount as the bill received in June.

What are the appropriate amounts for electricity to be included in the financial statements of Jingles Co for the year ended 30 June 20X1?

Statement of Statement of

financial position profit or loss