快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出67题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

材料全屏

67

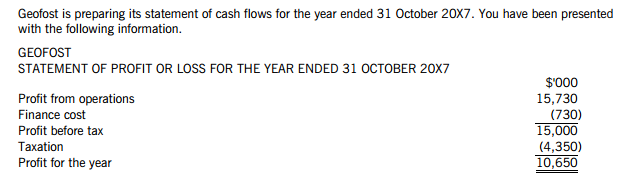

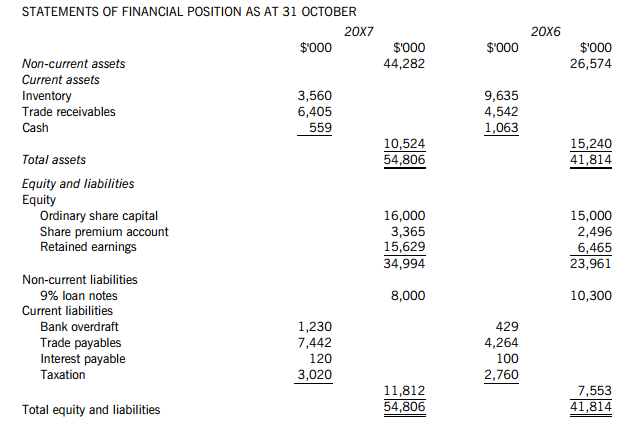

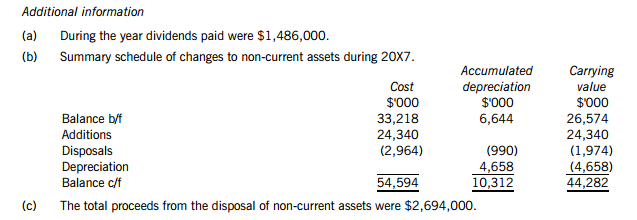

【论述题】

Prepare a statement of cash flows for Geofost for the year ended 31 October 20X7 in accordance with IAS 7 Statement of cash flows, using the indirect method.

Which of the following statements is/are incorrect?

1 A Co owns 25% of the ordinary share capital of B Co, which means that B Co is an associate of A Co.

2 C Co can appoint 4 out of 6 directors to the board of D Co, which means that C Co has control over D Co.

3 E Co has the power to govern the financial and operating policies of F Co, which means that F Co is an associate of E Co.

4 G Co owns 19% of the share capital of H Co, but by agreement with the majority shareholder, has control over the financial and operating policies of H Co, so H Co is an associate of G Co.

Clementine Co has owned 21% of the ordinary shares of Tangerine Co for several years. Clementine Co does not have any

investments in any other companies. How should the investment in Tangerine Co be reflected in the financial statements of

Clementine Co?

Which of the following statements relating to parent companies and subsidiaries are correct?

1 A parent company could consolidate a company in which it holds less than 50% of the ordinary share capital in certain circumstances.

2 Goodwill on consolidation will appear as an item in the parent company's individual statement of financial position.

3 Consolidated financial statements ignore the legal form of the relationship between parents and subsidiaries and present the results and position of the group as if it was a single entity.

P Co, the parent company of a group, owns shares in three other companies. P 0〇!3 holdings are:

Q Shares giving control of 60% of the voting rights in Q Co R Shares giving control of 20% of the voting rights in R Co. remove all the directors of R Co P Co also has the right to appoint orS Shares giving control of 10%of the voting rights in S Co,shares

plus 90% of the non-voting preference

Which of these companies are subsidiaries of P Co?

Which of the following should be accounted for in the consolidated financial statements of Company A using equity

accounting?

1 An investment in 51% of the ordinary shares of W Co

2 An investment in 20% of the preference (non-voting) shares of X Co

3 An investment in 33% of the ordinary shares of Y Co 4 An investment in 20% of the ordinary shares of Z Co, and an

agreement with other shareholders to appoint the majority of the directors to the board of Z Co

Breakspear Co purchased 600,000 of the voting equity shares of Fleet Co when the value of the noncontrolling interest in

Fleet Co is $150,000 The following information relates to Fleet at the acquisition date

At acquisition $!000

Share capital, $0.5 500

ordinary shares 150

Retained earnings 50

Revaluation surplus 700

The goodwill arising on acquisition is $70,000. What was the consideration paid by Breakspear Co for the investment in Fleet Co?

Date Co owns 100% of the ordinary share capital of Prune Co. The following balances relate to Prune Co.

At acquisition At 31.12.X8

Tangible non-current assets $’000 $’000

Freehold land 500 500

Plant and equipment 350 450

850 950

At acquisition, the fair value of Prune Co’s land was $50,000 more than shown in the financial statements of Prune Co. At 31 December 20X8, Date Co’s financial statements show a total tangible non-current asset balance of $1,250,000.

What amount should be included in the consolidated financial statements of the Date group at 31 December 20X8 for

tangible non-current assets?

Six Co owns 80% of the equity share capital of Seven Co. At 31 December 20X4, the trade receivables and trade payables of the two companies were as follows:

Six Co Seven Co

Trade receivables $64,000 $39,000

Trade payables $37,000 $48,000

These figures include $30,000 that is owed by Seven Co to Six Co for the purchase of goods, for which Six Co has not yet

paid. These goods were sold by Six Co for a profit of $15,000 and 50% of them were still held as inventory by Seven Co at

31 December 20X4.

What should be the amounts for trade receivables and trade payables in the consolidated statement of financial position as at 31 December 20X4?

Donna Co acquired 80% of the equity share capital of Blitsen Co on 1 January 20X4 when the retained earnings of Blitsen Co were $40,000. The fair value of the non-controlling interest at this date was $25,000. At 31 December 20X4, the equity capital of Blitsen Co was as follows:

Share capital $’000

40

Share premium 10

Retained earnings 60

110

During the year Blitsen Co sold goods to Donna Co for $20,000. This price included a mark-up of $12,000 for profit. At 31

December 20X4, 50% of these goods remained unsold in the inventory of Donna Co.

What is the value of the non-controlling interest in the Donna Group at 31 December 20X4, for the purpose of preparing the

consolidated statement of financial position?