快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Suggest one other course of action that AB might follow, explaining what you consider to be its merits and demerits when compared with your answer at (a) above.

A company can choose from four mutually exclusive investment projects. The return on the project will depend on market conditions.

The table below details the returns for each possible outcome:

A B C D

Poor $400,000 $700,000 $450,000 $360,000

Average $470,000 $550,000 $500,000 $400,000

Good $600,000 $300,000 $800,000 $550,000

If the company applies the maximin rule it will invest in:

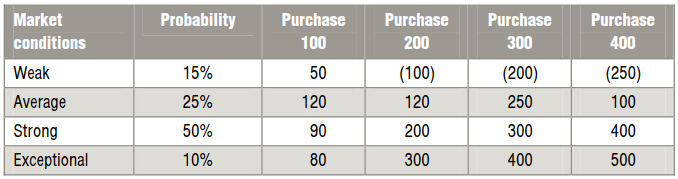

A supplier will supply company B in batches of 100 units, but daily demand is unpredictable. Company B has prepared a payoff table to reflect the expected profits if different quantities are purchased and in differing market demand conditions.

If the maximax criteria is applied, how many units would be purchased from the supplier?

If the maximax criteria is applied, how many units would be purchased from the supplier?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Which truck would the pessimistic buyer purchase? Enter only the letter:

Which truck would the pessimistic buyer purchase? Enter only the letter:

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Which truck would the optimistic buyer purchase? Enter only the letter:

Which truck would the optimistic buyer purchase? Enter only the letter:

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Based upon the scenario information, if the buyer was prone to regretting decisions that have been made which truck would the buyer purchase? Enter only the letter:

Based upon the scenario information, if the buyer was prone to regretting decisions that have been made which truck would the buyer purchase? Enter only the letter:

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Based upon the scenario information, if the probabilities of the given growth rates are 15%: 0.4, 30%: 0.25 and 40%: 0.35, which truck would the risk-neutral buyer purchase?

A manager has to choose between mutually exclusive options C and D and the probable outcomes of each option are as follows.

Both options will produce an income of $30,000. Which should be chosen, on the basis of the expected value decision rule?

Fill in the blanks.

(a) Maximin decision rule: choosing the alternative that …………….….... the ……...….……………..

(b) Minimax decision rule: choosing the alternative that ……………….… the …….….……………....

(c) Maximax decision rule: choosing the alternative that …….…………… the………...……………...

(d) Minimin decision rule: choosing the alternative that ……….………….. the…......…………………

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Appler is considering the relevant cash flows involved in a short-term decision. An important client has asked for the minimum price for the processing of a compound. The compound involves the following:

Material A: Appler needs 500 kg of material for the compound but has 200 kg in stock present. The stock items were bought 3 months ago for $5/kg but have suffered 10% shrinkage since that date. Material A is not regularly used in the business and would have to be disposed of at a cost to Appler of $400 in total. The current purchase price of material A is $6.25/kg.

Material B: Appler needs 800 kg of material B and has this in stock as it is regularly needed. The stock was bought 2 months ago for $4/kg although it can be bought now at $3.75/kg due to its seasonal nature.

Processing energy costs would be $200 and the supervisor says he would allocate $150 of his weekly salary to the job in the company’s job costing system.

Based upon the scenario information, what is the total cost for processing and supervision to be included in the minimum price calculation?