快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

A company operates a continuous process into which 3,000 units of material costing $9,000 was input in a period. Conversion costs for this period were $11,970 and losses, which have a scrap value of $1.50, are expected at a rate of 10% of input. There were no opening or closing inventories and output for the period was 2,900 units.What was the output valuation?

The following information relates to a company's polishing process for the previous period.

Output to finished goods 5,408 units valued at $29,744

Normal loss 276 units

Actual loss 112 units

All losses have a scrap value of $2.50 per unit and there was no opening or closing work in progress. What was the value of the input during the period?

Which of the following statements about process losses are correct?

(i) Units of normal loss should be valued at full cost per unit

(ii) Units of abnormal loss should be valued at their scrap value

Which of the following statements is/are correct?(i) A by-product is a product produced at the same time as other products which has a relatively low volume compared with the other products(ii) Since a by-product is a saleable item it should be separately costed in the process account, and should absorb some of the process costs(iii) Costs incurred prior to the point of separation are known as common or joint costs

Which of the following statements is/are correct?(i) A by-product is a product produced at the same time as other products which has a relatively low volume compared with the other products(ii) Since a by-product is a saleable item it should be separately costed in the process account, and should absorb some of the process costs(iii) Costs incurred prior to the point of separation are known as common or joint costs

A company manufactures two joint products and one by-product in a single process. Data for November are as follows.

$

Raw material input 216,000

Conversion costs 72,000

There were no inventories at the beginning or end of the period.

Output Sales price

Units $ per unit

Joint product E 21,000 15

Joint product Q 18,000 10

By-product X 2,000 2

By-product sales revenue is credited to the process account. Joint costs are apportioned on a sales value basis. What were the full production costs of product Q in November (to the nearest $)?

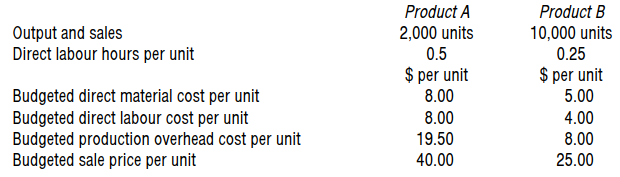

The following production budget is for a company that makes two products, A and B. The company's budgeted output and sales are restricted by a maximum number of 3,500 direct labour hours available in the budget period.

Product

Product

If the company were to use a throughput accounting system, what would be the throughput accounting ratio (TPAR) for Product B (to 2 dp)?

CD plc produces a single product, the BC, which passes through three different processes, Alpha, Beta and Gamma. The throughput per hour of the three processes is 25, 30 and 32 units of BC respectively. The organisation operates for ten hours a day, 5 days a week for 50 weeks of the year. The BC can be sold for $420 per unit and it has a material cost of $170 per unit. It is anticipated that annual conversion costs will be $1,800,000.

What is the throughput accounting ratio per day? (to 2 decimal places)

材料全屏

17

【论述题】

Calculate: Total profit per day

Calculate: Return per factory hour