快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

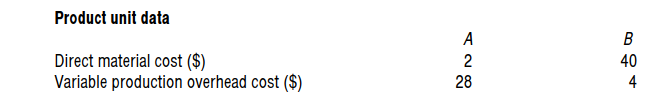

Calculate: Throughput accounting ratio

材料全屏

20

【论述题】

Using limiting factor analysis, calculate the contribution per bottleneck hour of Product B to the nearest dollar.

If F Co chooses to prioritise Product B, calculate the value (in $) of the maximum net profit.

Using throughput analysis, calculate the return per bottleneck hour of Product A.

Evans Co purchased a machine with an estimated useful life of 10 years for $76,000 on 30 September 20X5. The machine

had a residual value of $16,000.What are the ledger entries to record the depreciation charge for the machine in the year

ended 30 September 20X8?

Banter Co purchased an office building on 1 January 20X1. The building cost was $1,600,000 and this was depreciated by the straight line method at 2% per year, assuming a 50-year life and nil residual value. The building was re-valued to $2,250,000

on 1 January 20X6. The useful life was not revised. The company!s financial year ends on 31 December.

What is the balance on the revaluation surplus at 31 December 20X6?

A company purchased an asset on 1 January 20X3 at a cost of $1,000,000. It is depreciated over50 years by the straight line method (nil residual value), with a proportionate charge for depreciation in the year of acquisition and the year of disposal. At

31 December 20X4 the asset was re-valued to $1,200,000. There was no change in the expected useful life of the asset.The

asset was sold on 30 June 20X5 for $1,195,000.

What profit or loss on disposal of the asset will be reported in the statement of profit or loss of the company for the year ended 31 December 20X5?

According to IAS 38 Intangible assets, which of the following statements concerning the accountingtreatment of research and development expenditure are true?

1 Development costs recognised as an asset must be amortised over a period not exceeding five years.

2 Research expenditure, other than capital expenditure on research facilities, should be recognised as an expense as

incurred.

3 In deciding whether development expenditure qualifies to be recognised as an asset, it is necessary to consider whether

there will be adequate finance available to complete the project.

4 Development projects must be reviewed at each reporting date, and expenditure on any project no longer qualifying for

capitalisation must be amortised through the statement of profit or loss and other comprehensive income over a period no exceeding five years.

According to IAS 38 Intangible assets, which of the following are intangible non-current assets in the financial statements of

Iota Co?

1 A patent for a new glue purchased for $20,000 by Iota Co

2 Development costs capitalised in accordance with IAS 383 A licence to broadcast a television series, purchased by Iota Co

for $150,0004 A state of the art factory purchased by Iota Co for $1.5million

According to IAS 38 Intangible assets, which of the following statements about intangible assets are correct?

1 If certain criteria are met, research expenditure must be recognised as an intangible asset.

2 If certain criteria are met, development expenditure must be capitalised

3 Intangible assets must be amortised if they have a definite useful life

Original estimates of production/sales of products A and B are 120,000 units and 45,000 units respectively. The selling prices per unit for A and B are $60 and $70 respectively.

Original estimates of production/sales of products A and B are 120,000 units and 45,000 units respectively. The selling prices per unit for A and B are $60 and $70 respectively.