快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

What are the three steps of ZBB?

Evergreen Co owns 35% of the ordinary shares of Deciduous. What is the correct accounting treatment of the revenues and

costs of Deciduous for reporting period in the consolidated statement of profit or loss of the Evergreen group?

材料全屏

24

【论述题】

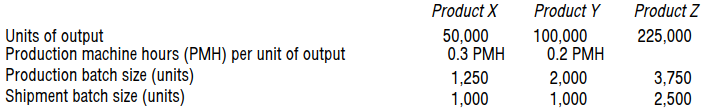

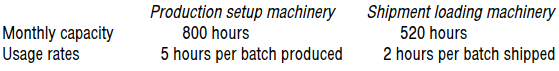

Use activity based budgeting to assess whether the resources currently owned or employed by the company are sufficient to meet typical monthly output. Comment on any significant surplus/shortfall in resource.

Mercedes Co has owned 100% of Benz Co since incorporation. At 31 March 20X9 extracts from their individual statements of financial position were as follows.

Mercedes Co Benz Co $ $

Share capital 100,000 50,000

Retained earnings 450,000 120,000

550,000 170,000

During the year ended 31 March 20X9, Benz Co had sold goods to Mercedes Co for $50,000. Mercedes Co still had these

goods in inventory at the year end. Benz Co uses a 25% mark up on all goods.

What were the consolidated retained earnings of Mercedes Group at 31 March 20X9?

Briefly outline THREE advantages that may be claimed for the use of activity based budgeting rather than a traditional incremental budgeting system.

Micro Co acquired 90% of the $100,000 ordinary share capital of Minnie Co for $300,000 on

1 January 20X9 when the retained earnings of Minnie Co were $156,000. At the date of acquisition the fair value of plant held by Minnie Co was $20,000 higher than its carrying amount. The fair value of the non-controlling interest at the date of acquisition was $75,000.

What is the goodwill arising on the acquisition of Minnie Co?

On 1 April 20X7 Possum Co acquired 60% of the share capital of Koala Co for $120,000. During the year Possum Co sold

goods to Koala Co for $30,000, including a profit margin of 25%. 40% of these goods were still in inventory at the year end.

The following extract was taken from the financial statements of Possum Co and Koala Co at 31 March 20X8.

Possum Co $'000 Koala Co

Revenue 750 $'000 400

Cost of sales (420) (100)

Gross profit 30 300

What is the consolidated gross profit of the Possum group at 31 March 20X8?

The management accountant of a business has identified the following information:

Activity level 800 units 1,200 units

Total cost $16,400 $23,600

The fixed costs of the business step up by 40% at 900 units.

What is the fixed cost at 1,100 units?

In order to form an agency relationship by express agreement, what form should the agreement take?

Which type of agent authority is derived from what is usual or customary in the circumstances?