快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

An investment project has the following discounted cash flows ($'000):

Year Discount rate

0% 10% 20%

0 90 90 90

1 30 27.3 25.0

2 30 24.8 29.8

3 30 22.5 17.4

4 30 20.5 14.5

30 5.1 (12.3)

The required rate of return on investment is 10% per annum. What is the discounted payback period of the investment project

What is the effective annual rate of interest of 2.1% compounded every three months?

If the interest rate is 8%, what would you pay for a perpetuity of $1,500 starting in the nearest $)

How much should be invested now (to the nearest $) to receive $24,000 per annum in perpetuity if the annual rate of interest is 5%?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Appler is considering the relevant cash flows involved in a short-term decision. An important client has asked for the minimum price for the processing of a compound. The compound involves the following:

Material A: Appler needs 500 kg of material for the compound but has 200 kg in stock present. The stock items were bought 3 months ago for $5/kg but have suffered 10% shrinkage since that date. Material A is not regularly used in the business and would have to be disposed of at a cost to Appler of $400 in total. The current purchase price of material A is $6.25/kg.

Material B: Appler needs 800 kg of material B and has this in stock as it is regularly needed. The stock was bought 2 months ago for $4/kg although it can be bought now at $3.75/kg due to its seasonal nature.

Processing energy costs would be $200 and the supervisor says he would allocate $150 of his weekly salary to the job in the company’s job costing system.

Based upon the scenario information, what is the total cost for processing and supervision to be included in the minimum price calculation?

材料全屏

28

【论述题】

Recommend, with supporting calculations, which of the two main courses of action suggested is the more advantageous from a purely cost and financial point of view.

Identify three major non-financial factors that AB would need to consider in making its eventual decision as to what to do.

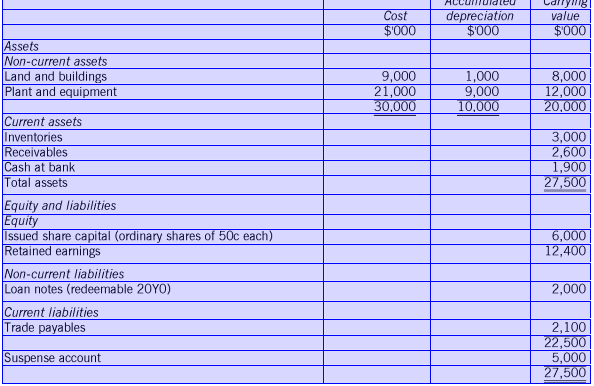

The statement of financial position as at 31 October 20X6

Suggest one other course of action that AB might follow, explaining what you consider to be its merits and demerits when compared with your answer at (a) above.

材料全屏

53

【简答题】

The proceeds of issue of 4,000,000 50c shares at $1.10 per share, credited to the suspense account from the cash book.