快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出469题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Which of the following items might be a suitable cost unit within the credit control department of a company?(i) Stationery cost(ii) Customer account

(iii) Cheque received and processed

Which of the following best describes a period cost?

A company employs four supervisors to oversee the factory production of all its products. How would the salaries paid to these supervisors be classified?

A company manufactures and sells toys and incurs the following three costs:

(i) Rental of the finished goods warehouse

(ii) Depreciation of its own fleet of delivery vehicles

(iii) Commission paid to sales staffWhich of these are classified as distribution costs?

Which of the following describes a cost centre?

The overhead expenses of a company are coded using a five digit coding system, an extract from which is

as follows:

Cost centre Code no Types of expense Code no

Machining 10 Indirect materials 410

Finishing 11 Depreciation of production machinery 420

Packing 12 Indirect wages 430

Stores 13 Maintenance materials 440

Maintenance 14 Machine hire costs 450

Depreciation of non-production equipment 460

The coding for the hire costs of a packing machine is 12450.

Which is the coding for the issue of indirect materials issued from stores to the machining department?

Which one of the following statements does NOT explain why coding systems are used?

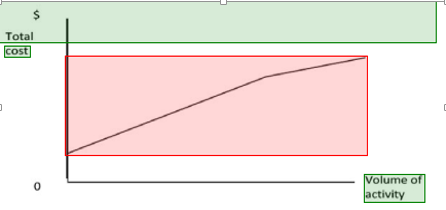

The following diagram represents the behaviour of one element of cost:Which one of the following descriptions is consistent with the above diagram?

An organisation has the following total costs at three activity levels:

Activity level (units) 8,000 12,000 15,000

Total cost $204,000 $250,000 $274,000

Variable cost per unit is constant within this activity range and there is a step up of 10% in the total fixed costs when the activity level exceeds 11,000 units.What is the total cost at an activity level of 10,000 units?

A firm has to pay a $0.50 per unit royalty to the inventor of a device which it manufactures and sells. How would the royalty charge be classified in the firm's accounts?