快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

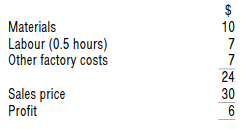

Product YZ2 is made in a production process where machine time is a bottleneck resource. Production of one unit of Product YZ2 takes 0.25 machine hours. The costs and selling price of Product YZ2 are as follows:

In a system of throughput accounting, what is the return per factory hour?

A company manufactures Product Q, which sells for $50 per unit and has a material cost of $14 per unit and a direct labour cost of $10 per unit. The total direct labour budget for the year is 18,000 hours of labour time at a cost of $10 per hour. Factory overheads are $1,620,000 per year. The company has identified machine time as the bottleneck in production. Product Q needs 0.05 hours of machine time per unit produced. The maximum capacity for machine time is 6,000 hours per year.

What is the throughput accounting ratio for Product Q (to 1 dp)?

Which two of the following statements about activity based costing are true?

Which two of the following statements about activity based costing are true?

ABC is felt to give a more useful product cost than classic absorption costing (with overheads absorbed on labour hours) if which of the following two apply?

Calculate the overhead cost of centre hire which would be allocated to an auditing course under activity based costing to the nearest dollar.

Calculate the overhead cost of brochure printing which would be allocated to a taxation course under activity based costing to the nearest dollar.

Calculate the overhead cost of enquiries administration which would be allocated to a taxation course under activity based costing.

A member of Southcott Co's finance team has said that activity based costing (ABC) provides more accurate product costs than a traditional absorption costing system. He gave a number of statements supporting this claim.

Which of the following statements does NOT support his claim?

【论述题】

Calculate the total costs of producing the budgeted amount of Sunshine motorcycles based on the existing method of attributing overheads.

The three cost drivers that generate overheads are:

The three cost drivers that generate overheads are: