快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

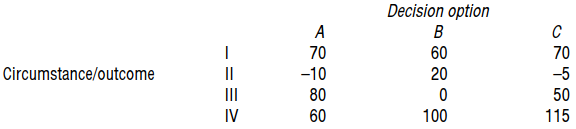

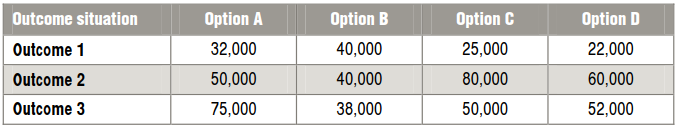

The following pay-off table shows the monthly contribution that would be earned from each of four mutually exclusive options (options A-D) given three different outcome situations. It is not possible to predict or estimate the probability of each outcome scenario.

If the choice of option is made on the basis of the minimax regret criterion, which option will be selected?

Match the type of investor to the attitude to risk:

Risk averse (i) Minimax regret (ii) Relevant costing

(iii) Perfect information (iv) Maximin

(v) Maximax (iv) Expected values

Risk seeker (i) Minimax regret (ii) Relevant costing

(iii) Perfect information (iv) Maximin

(v) Maximax (iv) Expected values

Risk neutral (i) Minimax regret (ii) Relevant costing

(iii) Perfect information (iv) Maximin

(v) Maximax (iv) Expected values

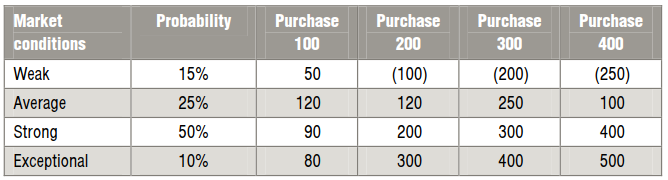

A supplier will supply company A in batches of 100 units, but daily demand is unpredictable. Company A has prepared a payoff table to reflect the expected profits if different quantities are purchased and in differing market demand conditions.

If the maximin criteria is applied, how many units would be purchased from the supplier?

If a material event occurs after the reporting date but before the financial statements are authorised for issue outside the

organisation, and this event does NOT require adjustment, what information should be disclosed in the financial statements?

材料全屏

18

【论述题】

State which option would be selected using

The maximax decision rule

Which of the following items could appear in a company's statement of cash flows?

1 Surplus on revaluation of non-current assets

2 Proceeds of issue of shares

3 Proposed dividend

4 Irrecoverable debts written off

5 Dividends received

State which option would be selected using

The maximin decision rule

Part of the process of preparing a company's statement of cash flows is the calculation of cash inflow from operating activities.

Which of the following statements about that calculation (using the indirect method) are correct?

1 Loss on sale of operating non-current assets should be deducted from net profit before taxation.

2 Increase in inventory should be deducted from operating profits.

3 Increase in payables should be added to operating profits.

4 Depreciation charges should be added to net profit before taxation.

材料全屏

20

【论述题】

Prepare a summary which shows the budgeted contribution earned by Stow Health Centre for the year ended 30 June 20X1 for each of nine possible outcomes.

In the course of preparing a company's statement of cash flows, the following figures are to be included in the calculation of

net cash from operating activities

$

Depreciation charges 980,000

Profit on sale of non-current assets 40,000

Increase in inventories 130,000

Decrease in receivables 100,000

Increase in payables 80,000

What will the net effect of these items be in the statement of cash flows?