快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出2330题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

An incremental budgeting system is:

IAS 7 requires the statement of cash flows to open with the calculation of net cash from operating

activities, arrived at by adjusting net profit before taxation.

Which one of the following lists consists only of items which could appear in such a calculation?

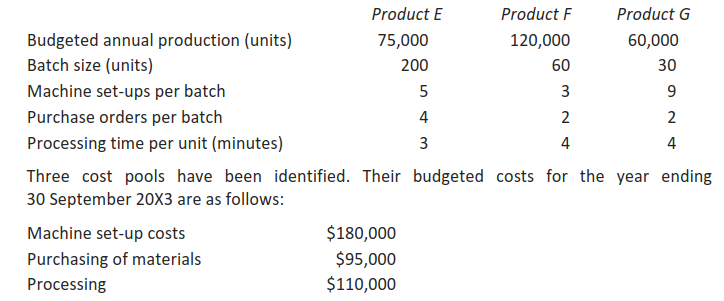

EFG uses an Activity Based Budgeting system. It manufactures three products, budgeted details of which are set out below:

What is the budgeted machine set-up cost per unit of product F?

What is the budgeted machine set-up cost per unit of product F?

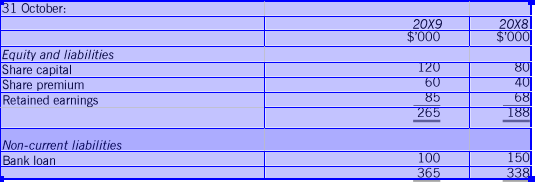

The following extract is from the financial statements of Pompeii, a limited liability company at

What is the cash flow from financing activities to be disclosed in the statement of cash flows for the year ended 31 October

20X9?

The following statements have been made regarding different types of budget:

(i) A flexible budget can be used to control operational efficiency.

(ii) Incremental budgeting can be defined as a system of budgetary planning and control that measures the additional costs that are incurred when there are unplanned extra units of activity.

(iii) Rolling budgets review and, if necessary, revise the budget for the next quarter to ensure that budgets remain relevant for the remainder of the accounting period.

Which of the above statement(s) are true?

A draft statement of cash flows contains the following calculation of cash flows from operating activities:

$m

Profit before tax 13

Depreciation 2

Decrease in inventories (3)

Decrease in trade and other receivables 5

Decrease in trade payables 4

Net cash inflow from operating activities 21

Which of the following corrections need to be made to the calculation?

1 Depreciation should be deducted, not added.

2 Decrease in inventories should be added, not deducted.

3 Decrease in receivables should be deducted, not added.

4 Decrease in payables should be deducted, not added

X Co uses rolling budgeting, updating its budgets on a quarterly basis. After carrying out the last quarter’s update to the cash budget, it projected a forecast cash deficit of $400,000 at the end of the year. Consequently, the planned purchase of new capital equipment has been postponed.

Which of the following types of control is the sales manager’s actions an example of?

The following extract is taken from a draft version of company’s statement of cash flows, prepared by a trainee accountant.

$000

Net cash flow from operating activities Profit before tax Depreciation charges 484

Profit on sale of property, plant and equipment 327

Increase in inventories 35

Decrease in trade and other receivables (74)

Increase in trade payables (41)

Cash generated from operations 29

760

Four possible mistakes that may have been made by the trainee accountant are listed below.

1 The profit on sale of property, plant and equipment should be subtracted, not added.

2 The increase in inventories should be added, not subtracted.

3 The decrease in trade and other receivables should be added, not subtracted.

4 The increase in trade payables should be subtracted, not added.

Which of the four mistakes did the trainee accountant make when preparing the draft statement?

Which of the following statements regarding zero based budgeting are correct?

(1) It is best applied to support expenses rather than to direct costs.

(2) It can link strategic goals to specific functional areas.

(3) It carries forward inefficiencies from previous budget periods.

(4) It is consistent with a top-down budgeting approach.

Which, if any, of the following items could be included in ‘cash flows from financing activities’ in a statement of cash flows that complies with IAS 7 Statement of Cash Flows?

1 Interest received

2 Taxation paid

3 Proceeds from sale of property