快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出329题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Aluki fixes prices to make a standard gross profit percentage on sales of 20%.

The following information for the year ended 31 January 20X3 is available to compute her sales total for

the year.

$

Inventory: 1 February 20X2 243,000

31 January 20X3 261,700

Purchases 595,400

Purchases returns 41,200

What is the sales figure for the year ended 31 January 20X3?

P & Co maintain a receivables ledger control account within the nominal ledger. At 30 November 20X0, the

total of the list of individual balances extracted from the receivables ledger was $15,800, which did not agree

with the balance on the receivables ledger control account. An examination of the books revealed the following

information, which can be used to reconcile the receivables ledger and the receivables ledger control account.

1 The credit balance of $420 in Ahmed's payables ledger account had been set off against his account in the receivable

ledger, but no entries had been made in the receivables and payables ledger control accounts.

2 The personal account of Mahmood was undercast by $90.

3 Yasmin's balance of (debit) $780 had been omitted from the list of balances.

4 Thomas' personal account balance of $240 had been removed from the receivables ledger as a bad

debt, but no entry had been made in the receivables ledger control account.

5 The January total of $8,900 in the sales daybook had been posted as $9,800.

6 A credit note to Charles for $1,000, plus sales tax of $300, had been posted to the receivables ledger

control account as $1,300 and to Charles' personal account as $1,000.

7 The total on the credit side of Edward's personal account had been overcast by $125.

Which of these items need to be corrected by journal entries in the nominal ledger?

P & Co maintain a receivables ledger control account within the nominal ledger. At 30 November 20X0, the

total of the list of individual balances extracted from the receivables ledger was $15,800, which did not agree

with the balance on the receivables ledger control account. An examination of the books revealed the following

information, which can be used to reconcile the receivables ledger and the receivables ledger control account.

1 The credit balance of $420 in Ahmed's payables ledger account had been set off against his account in the receivables

ledger, but no entries had been made in the receivables and payables ledger control accounts.

2 The personal account of Mahmood was undercast by $90.

3 Yasmin's balance of (debit) $780 had been omitted from the list of balances.

4 Thomas' personal account balance of $240 had been removed from the receivables ledger as a bad

debt, but no entry had been made in the receivables ledger control account.

5 The January total of $8,900 in the sales daybook had been posted as $9,800.

6 A credit note to Charles for $1,000, plus sales tax of $300, had been posted to the receivables ledger

control account as $1,300 and to Charles' personal account as $1,000.

7 The total on the credit side of Edward's personal account had been overcast by $125.

Assuming that the closing balance on the receivables ledger control account should be $16,000, what is the opening

balance on the receivables ledger control account before the errors were corrected?

The balance on Jude Co’s payables ledger control account is $31,554. The accountant at Jude Co has discovered that she

has not recorded:A settlement discount of $53 received from a supplier; and A supplier’s invoice for $622.What amount should be reported for payables on Jude Co’s statement of financial position?

The accountant at Borris Co has prepared the following reconciliation between the balance on the trade payables ledger

control account in the general ledger and the list of balances from the suppliers ledger:

$

Balance on general ledger control account 68,566

Credit balance omitted from list of balances from payables ledger (127)

68,439

Undercasting of purchases day book 99

Total of list of balances 68,538

What balance should be reported on Borris Co’s statement of financial position for trade payables?

How should the balance on the payables ledger control account be reported in the final financial statements?

材料全屏

69

【论述题】

Prepare a statement of profit or loss for the year ended 31 May 20X6.(8 marks)

Prepare a statement of financial position as at that date.

A sole trader fixes his prices to achieve a gross profit percentage on sales revenue of 40%. All his sales are for cash. He

suspects that one of his sales assistants is stealing cash from sales revenue.

His trading account for the month of June 20X3 is as follows:

$

Recorded sales revenue 181,600

Cost of sales 114,000

Gross profit 67,600

Assuming that the cost of sales figure is correct, how much cash could the sales assistant have taken?

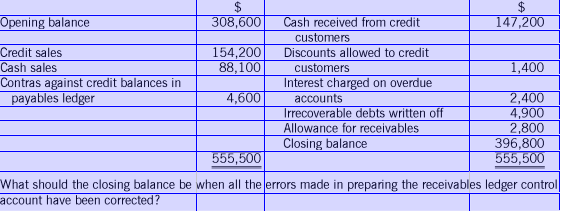

The following control account has been prepared by a trainee accountant:

RECEIVABLES LEDGER CONTROL ACCOUNT