快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Using the information in, and the results of, the question on page 7, determine budgeted overhead absorption rates for each of the production departments using appropriate bases of absorption.

The total production overhead expenditure of the company in the questions above was $176,533 and its actual activity was as follows.

Machine shop A Machine shop B Assembly

Direct labour hours 8,200 6,500 21,900

Machine usage hours 7,300 18,700 –--

Required

Using the information in and results of the previous questions, calculate the under- or over-absorption of overheads.

______________ is the process of determining the costs of products, activities or services.

Actual overheads cost $180,000 and 40,000 machine hours were worked.

Actual overheads cost $170,000 and 40,000 machine hours were worked.

【论述题】

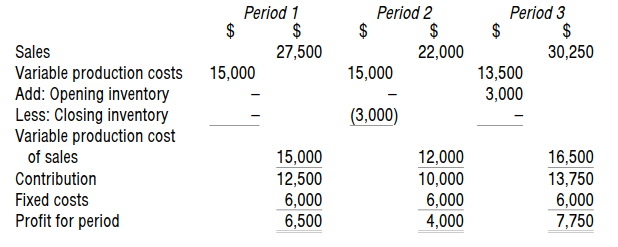

Prepare profit statements for each period and for the two periods in total using both absorption costing and marginal costing.

【论述题】

Prepare profit statements for each of the six-monthly periods, using the following methods of costing.

Marginal costing

Prepare profit statements for each of the six-monthly periods, using the following methods of costing.

Absorption costing

【论述题】

Production and sales for Period 1 were as follows:

Period 1

units

Sales 500

Production 500

Calculate the profit for period 1 based on absorption costing principles.

Production and sales for Period 2 was as follows:

Period 2

Units

Sales 400

Production 500

There was no opening inventory in Period 2. Calculate the profit for Period 2 based on absorption costing principles.